Whether you are applying for a loan to purchase a new home or looking to refinance your current home,review every personal and professional detail about yourselves to make sure they are accurate. An incorrect detail could be a red flag when the loan is being reviewed for funding and extra work will be required at the end.

1) Some lenders are pulling their clients' credits as late as the morning of the closing. If things were “close”, as in the example above, some are “crushed” when that simple “mistake” of a large credit card purchase will impact your credit. Don't close any accounts, increase any balances or add new debt.

2) Know your closing costs...get a good faith estimate before closing to make sure you know what to expect in closing,that you can make the deal happen and that when necessary,you can move funds into the appropriate account. Some lenders get nervous when the closing costs are paid by somebody else,like a family member as a gift. They wonder if it is a gift or necessity for their client. Could their client afford the home and the closing costs without any help. When interviewing lenders,ask about this.

3)Remember to lock in your interest rates. Some buyers...more so first time home buyers, “assume” that the rate that was quoted when they received Pre-Approval and were given a Good Faith Estimate, that nothing else needed to be done. The Buyer sadly learned otherwise when the interest rate during the time the GFE was prepared had risen to new levels. Unfortunately, even a small percentage increase can and did result in loan denial because said Buyer was very “close” to begin with, as far as debt ratios, ect. The Buyer’s previous loan “approval” was subsequently denied and the contract terminated. Even though interest rates have been staying low and pretty level,never assume rates are not going to go up and it is possible with the new rate you won't be approved for the loan.

4) Have your lender explain several loan programs to you,particularly those with lower prices to make sure they work for you. Your lender should tell you which programs he or she feels is best for you and most importantly,why.

5) If you are an independent contractor,a salesperson on straight commission or self-employed,many lenders will take the average of your last 2 years of tax returns to see that you have steady income since by the nature of how you earn your money,it isn't "guaranteed income". If you run your own business,talk to a lender or financial advisor about how to put money back into your business verses paying yourself so you get yourself in the most advantageous position to be approved for a new loan or to refinance.

6) With July 1, 2011 being this Friday and many salaried employees getting paid the first Friday of the month,make sure the address information of your employer is 100% correct. For instance, if on the check the employer's street reads "S.E" instead of "S.W.",it will cause the lender and underwriter to get verification of the company's existence (with correct address) and your employment. With the extra diligence taken in reviewing loans for approval,any disrepancy in information will make lenders nervous and force you to get further documentation to satisfy their concern.

7)Once you lock in your interest rate with your lender,don't look back. Nobody can predict the future and whether you locked in low or not. If you notice that interest rates dropped since you locked in,the only thing it may do is cause you is aggrivation. You could ask your lender if their is a program/fee for reducing your rate even after it is locked.

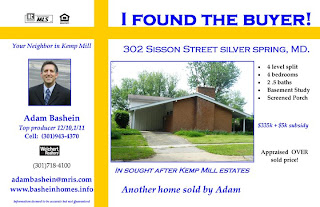

If you or anyone you know is thinking about getting in the market to buy or sell a home in Metro DC,have them call me...your helpful, full service realtor. I provide a Free No Obligation Pre-Market analysis of your situation,whether you are selling or buying.

Life is good!

Adam

Cell:(301)943-4370

O:(301)718-4100

adambashein@mris.com

www.basheinhomes.info

Licensed in MD & DC